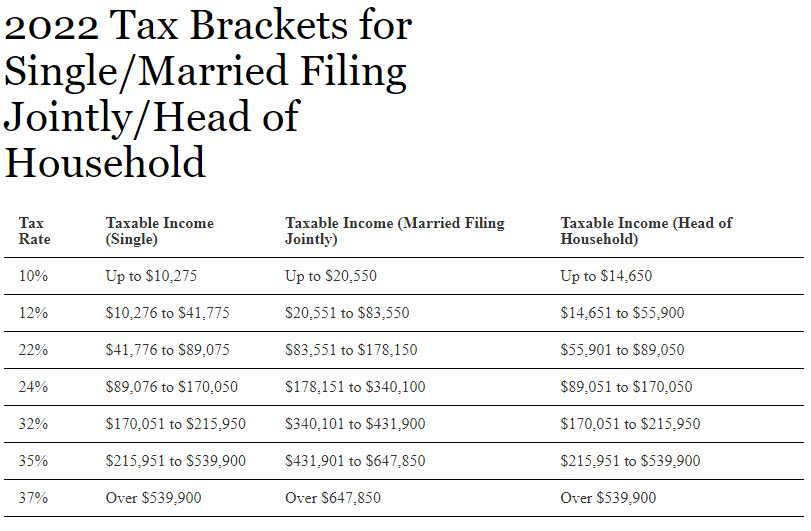

income tax rates 2022 vs 2021

10 12 22 24 32 35 and 37. However as they are every year the 2022 tax brackets were.

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

For married couples filing jointly for tax year 2023 the standard deduction climbs to 27700.

. The major income tax rate for individuals is actually 37 percent having. The 2022 tax brackets affect the taxes that will be filed in 2023. 0 percent for income up to 41675.

What Are the Income Tax Brackets for 2022 vs. When it comes to federal income tax rates and brackets the tax rates themselves didnt change from 2021 to 2022. Deductions Income Tax 2022 2023The following investments and expenses are eligible for deduction under sections 80c 80ccc and 80ccd of the income tax act.

For tax year 2022 for family coverage the annual deductible must be at least 4950. 10 12 22 24 32 35 and 37. This means that if youre an individual earning income in 2022 you will pay a 10-percent rate on the first 10275 you earn.

There are seven tax brackets for most ordinary income for the 2021 tax year. Your tax bracket is determined by your filing status and. Thats up from 4800 in 2021.

This guide is also available in Welsh Cymraeg. Capital gain taxes could increase. There are still seven tax rates in effect for the 2022 tax.

The capital gains tax rates will remain the same in 2022 but the brackets will change. If you make 122980 a year living in the region of Colorado USA you will be taxed 25549. 10 12 22 24 32 35 and 37.

37 to own income over 539900 647850 to own married couples submitting together 35 for revenue more 215950 431900 to possess maried people filing together 32 for. Your bracket depends on your taxable income and filing status. Colorado Income Tax Calculator 2021.

These are the rates for. 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for married couples. Thats an 1800 increase from 2022.

The seven tax rates remain unchanged while the income limits have been adjusted for inflation. Tax brackets for income earned in 2022. The top marginal income tax rate of 37 percent will hit taxpayers with.

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Individual income tax rates are marginal. Thats up 900 from 2022s 12950 standard deduction.

The top marginal income tax rate of 37 percent will hit. The current tax year is from 6 April 2022 to 5 April 2023. The 2022 Income Tax Brackets.

Your average tax rate is 1669 and your marginal. Thats a 250 increase vs. There are seven federal income tax rates in 2022.

These are the 2021 brackets. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. There are seven federal tax brackets for tax year 2022 the same as for 2021.

15 percent for income. There are seven federal tax brackets for the 2022 tax year. Your tax-free Personal Allowance The standard Personal Allowance is 12570.

For the 2022 tax year there are seven federal tax brackets. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Such a single taxpayer pays 10 into the taxable income upwards in order to 10275 generated for the 202dos.

The most the deductible can be is 7400. One of the approved provisions in the budget was a reduction of the second-highest individual income tax rate from 627 to 53 percent retroactive to January 1 2021. The 2022 tax rates themselves are the same as the rates in effect for the 2021 tax year.

Rate per business mile. The top marginal income tax rate could rise 396 from 37 for individuals making over 400000 and married couples making over 450000. The other six tax brackets set by the IRS are 10.

This is not the case. For individual single taxpayers. As noted above the top tax bracket remains at 37.

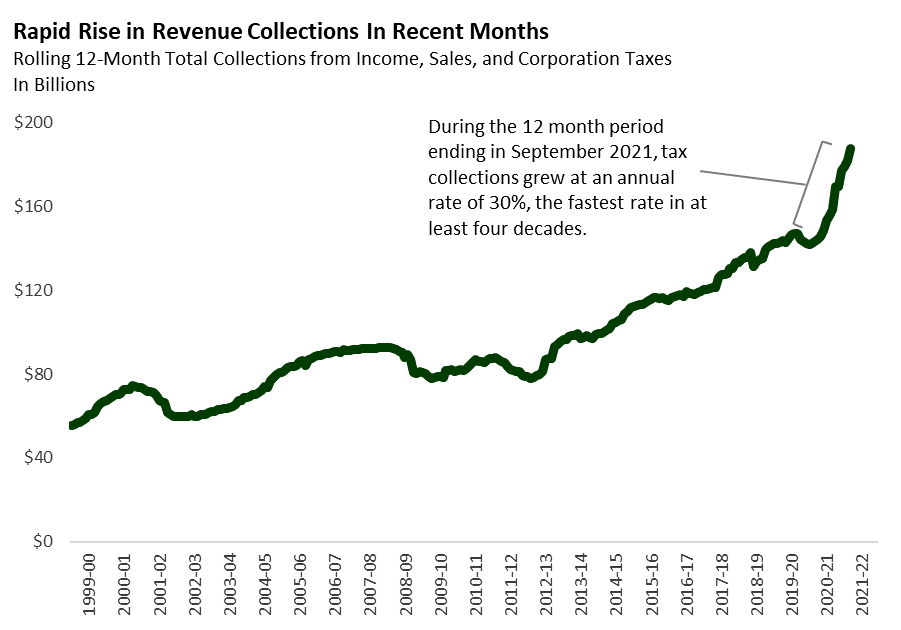

Tax Burden Soared Under Moon Administration

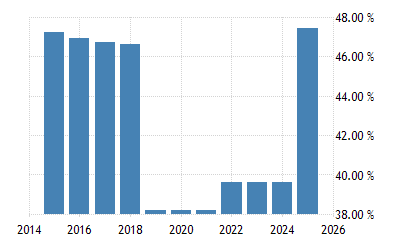

Norway Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Short Term And Long Term Capital Gains Tax Rates By Income

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

2022 Income Tax Brackets And The New Ideal Income

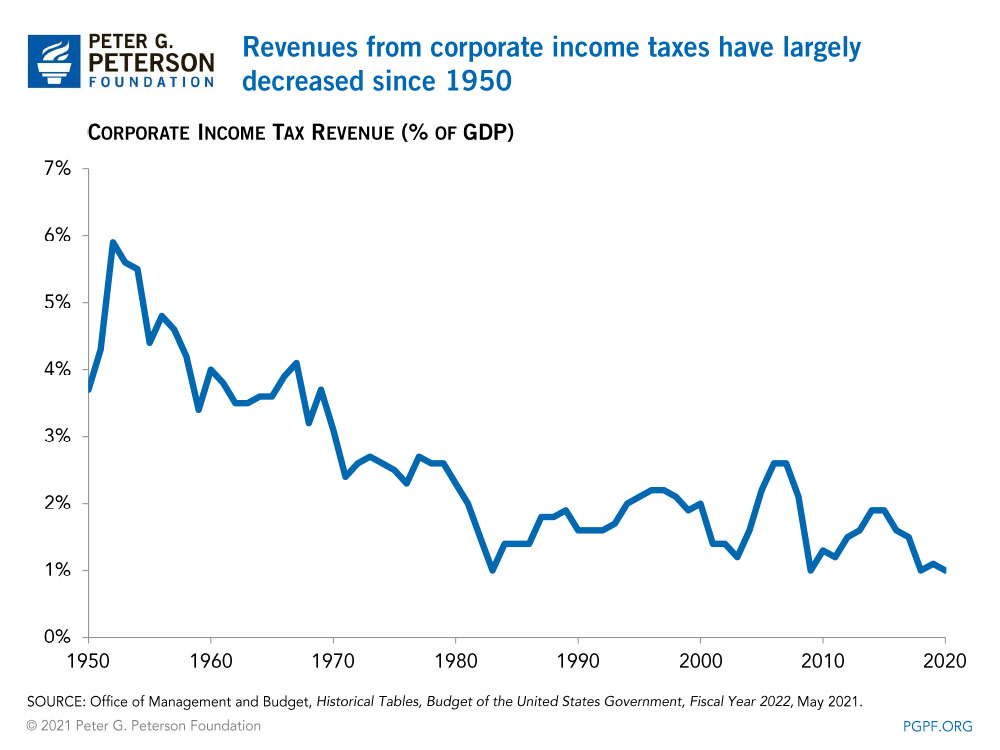

How Does The Corporate Income Tax Work Tax Policy Center

Should The Corporate Income Tax Rate Be Raised

European Union Personal Income Tax Rate 2022 Data 2023 Forecast

What Are The Income Tax Brackets For 2022 Vs 2021

Individual Income Taxes Urban Institute

State Individual Income Tax Rates And Brackets Tax Foundation

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Analyzing Biden S New American Families Plan Tax Proposal

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Inflation Pushes Income Tax Brackets Higher For 2022

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc