take home pay calculator manitoba

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. 45 000 - Taxes - Surtax - CPP -.

For a quote use the Fee Calculator.

. A take home pay calculator Manitoba can help you calculate your take-home income. Deposit Rocket issues a Guarantee that your Realtor submits along with your offer instead of a cash deposit or certified cheque. Manitoba first-time home buyer rebate.

These contributions makes that the self-employed must pay more than a regular employee. You can get a premium credit of 50 for the home that you sold in Toronto which will result in a premium credit of 10000. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month.

How much tax do you pay when you sell. Personal Income Tax Calculator - 2020 Select Province. RRSP Home Buyers Plan The Federal Governments Home Buyers Plan was created in 2019 to allow first-time home buyers to withdraw up to 35000 tax-free from their registered.

A corporations capacity to pay eligible dividends depends mostly on its status. Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon. There are however several first time home buyer programs available at the federal level that would-be homeowners in Manitoba can take advantage of.

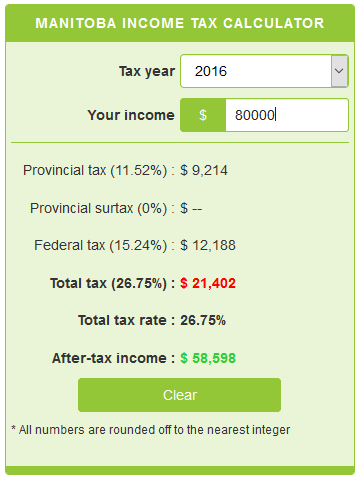

Manitoba tax bracket Manitoba tax. TurboTax free Canada income tax calculator for 2021 quickly estimates your federal and provincial taxes. It enables you to convert up to 55 of your homes value into tax-free cash while staying in your home.

You dont have to make any regular mortgage payments or pay back the loan until you move or sell. The CMHC premium for your home in Ottawa is 15000. The Canada Monthly Tax Calculator is updated for the 202223 tax year.

It is designed exclusively for Canadian homeowners aged 55 years and older. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax TablesUse the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review NIS payments and income.

Just enter your annual pre-tax salary. You do not need to borrow from friends and family liquidate investments and pay breakage and interest fees or obtain certified cheques a line of credit or bridge financing. Find out your tax refund or taxes owed plus federal and provincial tax rates.

You can quickly calculate your net salary or take-home pay using the calculator above. Unlike some other provinces Manitoba does not offer a rebate of land transfer taxes for first-time homebuyers. Tax figures for 2022.

Example Manitoba land transfer tax calculation. This tool will estimate both your take-home pay and income taxes paid per year month and day. The new version of the income tax calculator take into consideration the QPP EI QPIP RRSP for both employee and self-employed individual from Québec Canada.

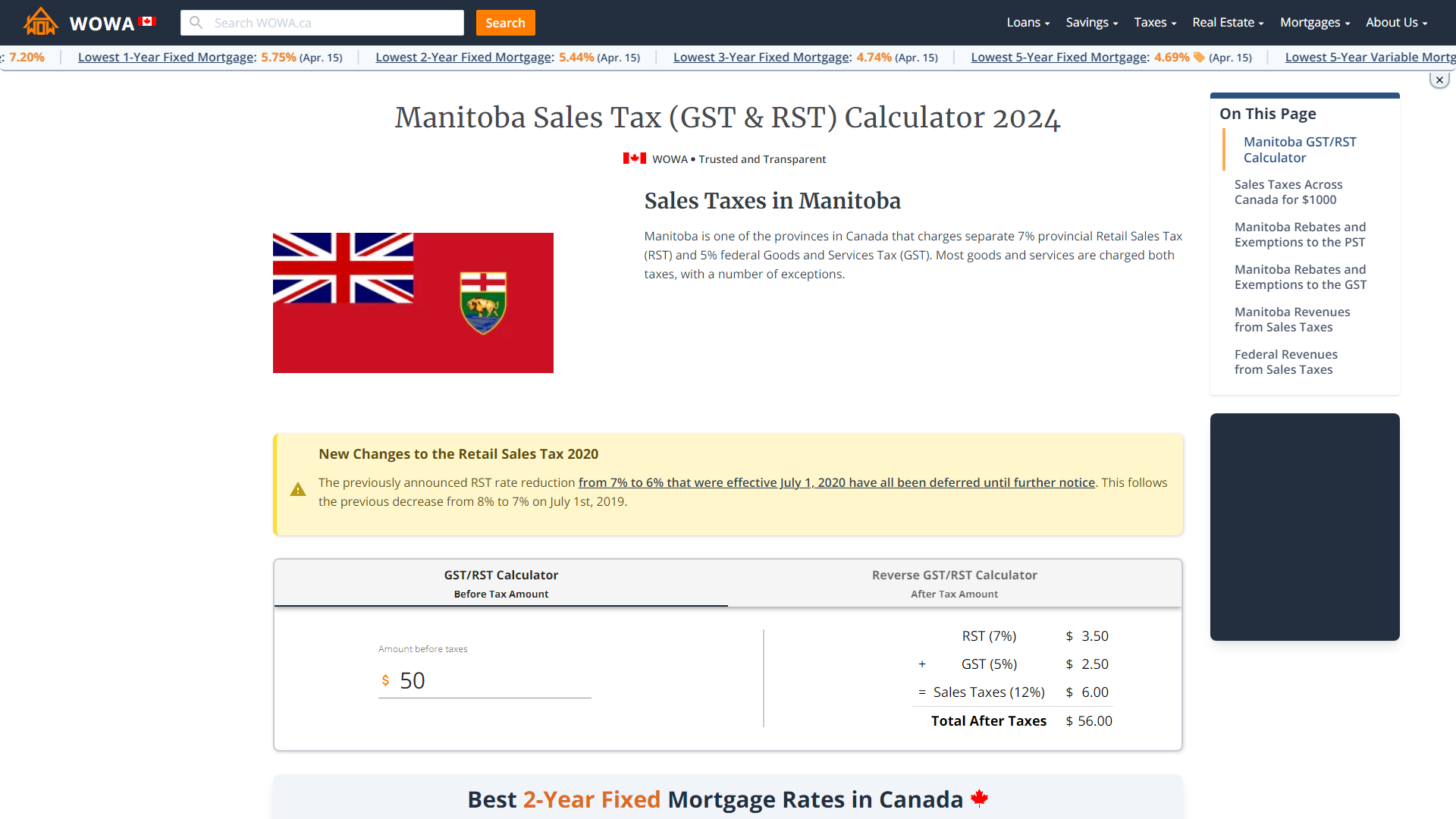

In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you-earn PAYE system. Sales tax calculator Manitoba GSTPST or RST 2020. 2021 free Manitoba income tax calculator to quickly estimate your provincial taxes.

This is applied against your new CMHC mortgage in Ottawa meaning that you will only have to pay a 5000 CMHC insurance premium. Non-educational loans eg home equity loan. The ability to pay off student loans more than a decade in advance has really provided tremendous financial flexibility to remain in an academic research faculty position.

Income taxes paid Federal This is. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. The total award will be calculated by NIH and may be different than the values shown in this calculator.

Marissa is eligible for 18000 from the Government of Canada First-Time Home Buyer Incentive allowing her to take out a mortgage of only 282000 plus insurance.

Uoft Gpa Calculator How To Calculate Your U Of T Gpa 2021 1 Gpa Calculator Student Portal Gpa

Small Town Vibes With Big City Size Charleswood Winnipeg Manitoba Realtor Ca Blog Suburbs Small Towns Neighborhood Guide

Manitoba Spousal Support Calculator

![]()

Manitoba Income Tax Calculator For 2022

Western Ontario And Mcmaster Universities Osteoarthritis Index Womac Therapy Help Osteoarthritis Mcmaster University

Avanti Gross Salary Calculator

2022 Manitoba Tax Calculator Ca Icalculator

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Pin On Winnipeg Manitoba Etsy Shops Sellers

Manitoba Gst Calculator Gstcalculator Ca

Manitoba Salary After Tax Calculator World Salaries

Manitoba Income Tax Calculator Calculatorscanada Ca

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income